The all-items rate peaked at 9.6% in October 2022 and has since fallen to 6.4% in July 2023. Over the last two years there has been a steep rise in the common component inflation rate which peaked at 7.3% in May 2023 before falling to 6.8% in July 2023. Resultsįigure 1 shows our estimate of the common component of inflation in the CPIH index alongside the aggregate CPIH (all-items) inflation rate. For those items with a low signal-to-noise ratio, the individual component is a relatively more important determinant of the inflation rate.

Items with a relatively high signal-to-noise ratio are more strongly correlated with the common inflation component and representative of the underlying trend rate of inflation in the economy. In other words, we interpret the signal-to-noise ratio for a CPIH item as a measure of its inflation persistence. The greater the signal-to-noise ratio, the greater the association between that item's inflation rate and the common inflation component. This means that we can interpret the signal-to-noise ratio for each item as 1/var(ϵi), which reflects how much of the 12-month inflation rate (CPIH t) is signal (S) compared with noise (ϵ i). Note that the variance of the error term governing the common inflation component (ν) has been set equal to one. The complete model consisting of 88 equations can easily be set up in state-space form and estimated using the Kalman filter. The coefficient ρ determines the effect of the inflation rate in the previous month on the current inflation rate. Direct estimation of this underlying common trend will then serve as a measure of the persistent part of inflation.įederal Reserve Bank of Chicago's An Alternative Measure of Inflation paperįederal Reserve System's common measure of inflationįederal Reserve Bank of New York's underlying inflation gaugeīank of England's How broad-based is the increase in UK inflation publication That is, the general path of inflation that broadly represents most of the goods and services purchased by households. We describe inflation persistence as the underlying trend inflation rate in the economy that is common across all the goods and services making up the consumer prices index (including housing costs). We follow a different approach in this article. For more information about this approach, see Bank of England's Core Inflation in the UK papers and European Central Bank's Persistence-weighted Measure of Core Inflation in the Euro Area paper.

Weak negative correlation scatter plot series#

The most common way of doing this is a time series econometrics approach using the strength of autoregressive (AR) coefficients, that is, the extent to which the current rate of inflation of a particular good or service reflects its rate of inflation in the past. For example, the Office for National Statistics (ONS) definition of core inflation excludes food, energy, alcoholic beverages, and tobacco.Ĭore inflation can also be estimated by directly observing the more persistent components of the price index and giving them exclusive or higher weights in the inflation calculation. A typical and straightforward approach is to identify those classes of goods and services where prices are volatile and either remove them or give them lower weights in the inflation calculation. There are a number of different methods for estimating core inflation.

Weak negative correlation scatter plot drivers#

It excludes volatile and transitory components of the price index, such as the movements in food and energy prices experienced over the last two years, which can be significant drivers of short-term inflation patterns. Core inflation is an underlying rate of inflation in the economy that is more likely to be representative of the medium-term inflation rate than the headline rate.

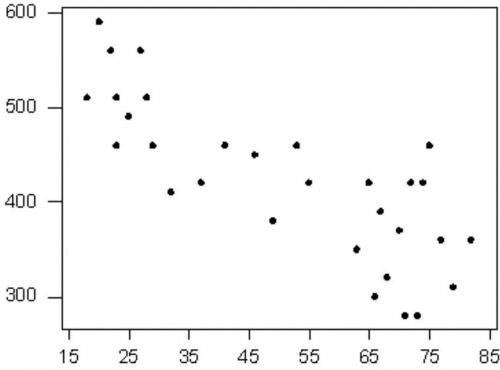

Our approach to measuring persistence in the rate of consumer prices inflation is closely related to the concept of core inflation. Overview of persistence in consumer prices inflation The inflation rate in the restaurants and cafes class is found to be a good measure of the underlying trend in consumer prices inflation in the UK economy.Īcross the 87 classes of goods and services making up the CPIH, there is a clear inverse relationship between items that display relative inflation persistence and those that display relative inflation volatility.Ģ. The persistent or common inflation component of the Consumer Prices Index including owner occupiers' housing costs (CPIH) was 6.8% over the 12 months to July 2023 although the all-items CPIH inflation rate reached its peak in October last year and had fallen to 6.4% in July 2023, the persistent component of the inflation rate has been slower to reach a turning point and so the subsequent fall in the inflation rate has been smaller. The persistent component of consumer prices inflation is identified as that part of inflation which is common to all goods and services in the index this can be considered as the general underlying trend or core inflation rate across the whole economy.

0 kommentar(er)

0 kommentar(er)